The factors of production: land, labor, capital, and entrepreneurship are provided by the household sector to both the business firms and the government. The three-sector model involves flow between the household, business firm, and government sectors. Gross National Income is similar to Gross National Product as it can be consumed or saved: If the financial sector was to be included in this model that would have savings & investments, below would be the calculation for the two-sector model from the expenditure method: The above model is an uncomplicated representation of the circular flow of money between two sectors, but in reality, the premise that 100% of the income is saved by the household or that 100% is spent on purchasing goods & services is not accurate. Also, foreign trade is excluded as this is a closed economic model. The two-sector model assumes that there is no government involvement, so there are no taxes or public services & goods provided.

The flow of money differs in volume as per the economic cycles.

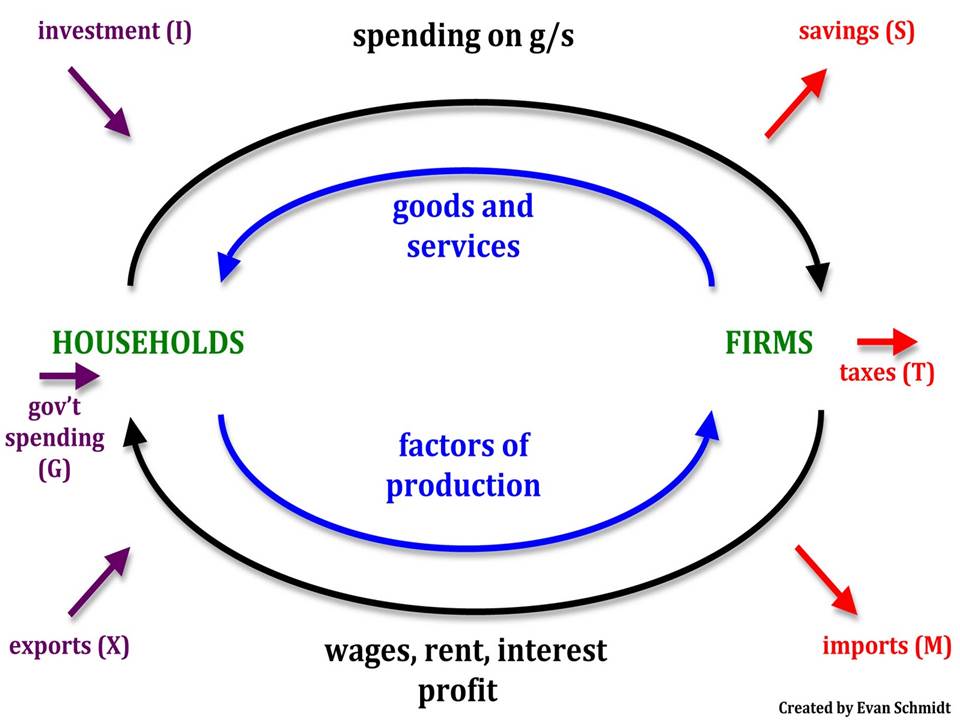

The money flows from the household (as an expenditure to the household) to the businesses and back when the households purchase the goods & services (reflected by the green arrow in Figure 1) provided by the firms. The firms make payments for the factors of production (listed as labor in the green arrow above) in the form of wages, rent, interest, and profit (income for household reflected in the blue arrow in Figure 1) to the household sector. The factors of production, i.e., land, labor, capital, and entrepreneurship, are delivered by the household sector to the business firms. The two-sector model applies the flow of factors and funds between the household sector and business firms sector. Leakages: Funds flowing out of the economy in the form of household savings, taxes paid by the households & the businesses to the government, and money expended on imports. Injections: Funds injected into the economy, such as investments, government spending, and money attained through exports.Ģ. Injections & Leakages are the notions that explain the flow of funds in and out of an economy:ġ. Entrepreneurship: Human resources that can combine the other factors, initial investments, initiatives, etc., to start/grow a business. Capital: Includes fixed capital such as equipment, etc., and working capital involving semi-finished products used to produce finished goods.Ĥ. Labor: Involves the workers that are paid varied wages according to their skills and contribution.ģ. Land: Involves the natural resources that are essential for production in some way or the other for any business.Ģ. Listed below are the factors of production:ġ. These factors affect the price of the products and also profit-making ability.

Financial sector: Indicates the savings and investments in an economy through banking and other financial institutions.įactors of production are the necessary inputs that are required for the production and manufacturing of goods and services in an economy. Foreign sector: In an open economy, it indicates the imports, exports, and foreign exchange with the rest of the world.ĥ. Government: Utilizes the resources in the economy to provide public goods and services and regulate the functioning of the economy.Ĥ. Firms: Production Units/Businesses that produce goods and services by utilizing factors of production.ģ. Households: They own all the resources in the economy and are comprised of individuals/consumers.Ģ. The model was then improvised with the practical applicability in terms of the flow of money that Karl Marx construed.įurthermore, a significant improvement was made in 1933 by John Maynard Keynes and his assistant, which further developed the concept for the United Nations that is the current model used now.īefore getting into the different parts of the model, below are the different agents and factors of production involved in all the models:Įconomic agents, namely households, firms, governments, foreign, and financial sectors, that display the circular flow of goods & services, factors of production, payments & receipts, and savings & investments in the markets.ġ. It was conceptualized back in the 1730s by the economist Richard Cantillion, and it was visualized by François Quesnay. It helps in the calculation of national income and is one of the key indicators in macroeconomics. The circular flow model of the economy is a simplified aid that illustrates how money flows throughout the economy, or in an economic sense, the redistribution of income between the decision-makers for resources and production.

0 kommentar(er)

0 kommentar(er)